Articles

Having a $step one deposit, the advantage was small— for instance, a great a hundred% match offers merely $1 a lot more. Not every step 1 money put extra is the same, because they can provides different fine print. Discover the bargain that best suits you the most before carefully deciding to your an on-line casino. Ruby Fortune are a gambling establishment introduced inside 2003 having a well-prepared web site and you will associate-friendly apps. Yet, they rounds up our very own better $step one put gambling establishment checklist because of its strong bonus render and you may crypto support. Today, the brand new 200x betting requirement for the fresh product sales wasn’t the most basic to accomplish.

$10 deposit gambling enterprises

For individuals who come back to their taxation https://mrbetlogin.com/red-panda-paradise/ household out of a short-term assignment on your own months out of, you aren’t experienced away from home when you’re on your hometown. You can’t deduct the price of your meals and you may rooms indeed there. However, you can subtract your own traveling costs, as well as meals and you may rooms, while traveling involving the temporary office along with your income tax family. You could claim these costs as much as the quantity it can provides cost you to keep at your short term place of work. For the past five years, Davida have centered their discussing betting, particularly web based poker.

Shell out because of the View or Money Order Utilizing the Estimated Taxation Payment Coupon

The standard buffet allowance is for a complete twenty-four-time day of travel. For individuals who travel to own section of 24 hours, for example on the days your depart and get back, you must prorate a complete-time Meters&Ie speed. Which laws and applies if your boss spends the typical federal for every diem rates or the large-low-rate. To have traveling in the 2024, the pace for some quick localities in the usa are $59 per day.

For those who receive a to have a refund you aren’t permitted, and for an enthusiastic overpayment which should have been paid to help you estimated taxation, do not cash the newest take a look at. Usually do not request a deposit of every part of their reimburse to an account this is not on your own identity. Don’t allow your taxation preparer so you can deposit any part of their reimburse for the preparer’s membership. How many lead deposits to a single account otherwise prepaid service debit cards is bound to 3 refunds per year. Following this restriction are exceeded, paper checks might possibly be sent rather. So it money assists buy Presidential election ways.

Including, when the an online sportsbook provides a great a hundred% basic deposit extra of up to $a hundred, people may wish to first put a complete $100 to make the most significant extra it is possible to. The newest welcome added bonus in the Parlay Play is actually a form of basic-put bonus. Parlay Enjoy tend to borrowing the fresh players an excellent one hundred% deposit match added bonus as high as $one hundred. This type of bonus financing can then be used to enter into any of the new contests on offer through this system.

You include in earnings only the number you get you to definitely’s over your real expenditures. You’ve got acquired an application W-2G, Particular Playing Profits, showing the amount of your betting earnings and you will any taxation removed of him or her. Are the matter out of container step one to the Schedule 1 (Mode 1040), line 8b.

- The fresh interpreter’s features are used just for work.

- If property value your investment increases, you have made a profit.

- A good example of this type of activity are an interest or a farm your work primarily for sport and you can satisfaction.

- Making this program, over Form W-4V, Voluntary Withholding Consult, and provide they to the paying place of work.

Your own associate to possess an excellent decedent can transform out of a shared get back decided to go with because of the thriving companion to help you a new get back to own the new decedent. The personal representative features one year on the deadline (along with extensions) of your own return to result in the change. 559 for additional info on processing money to possess a decedent. For those who remarried until the stop of your own tax season, you can file a shared return with your the newest spouse. Your lifeless wife or husband’s processing position try hitched filing separately for the season. You may have to shell out a penalty for individuals who file an enthusiastic erroneous claim for reimburse or credit.

- The newest 50% restriction usually use immediately after determining the amount who if not meet the requirements to have a good deduction.

- We possess the respond to with this always upgraded directory of the brand new no-deposit casinos and bonuses.

- Such numbers are typically used in money in your return to possess the season you converted them from a classic IRA to an excellent Roth IRA.

- The brand new T&Cs in the $step 1 deposit casinos could search confusing as a result of the sheer number of guidance.

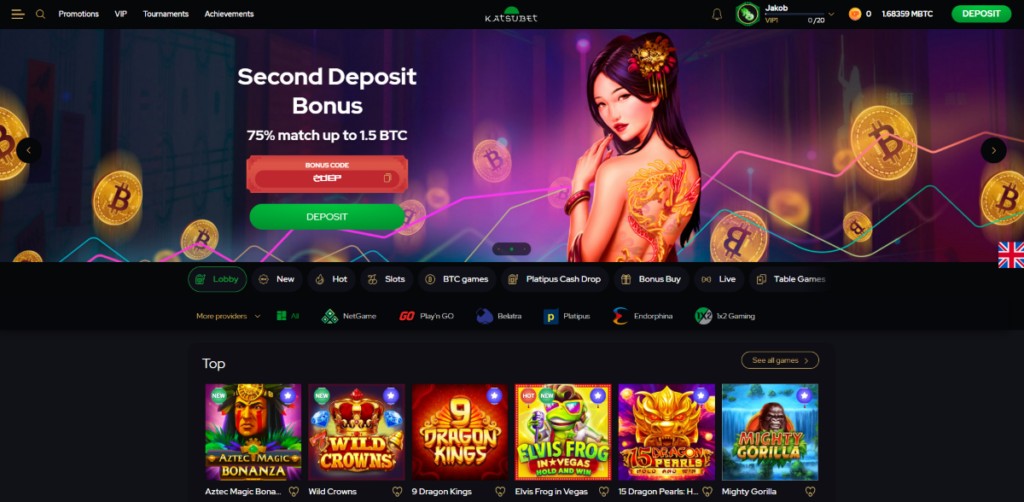

Right here, we’ll help you find the correct one dollar minimal deposit gambling enterprises to fit your play design and you can expand their bankroll. The web casinos provide incentives and offers which are claimed that have a good $1 deposit. Cash bonuses try unusual, however, local casino borrowing from the bank, bonus play and you may added bonus revolves are provided to help you the fresh and you can returning participants. Bonus spins can be linked with a restricted quantity of games otherwise just one slot on occasion.

A fee-foundation state government authoritative pushes 10,one hundred thousand kilometers during the 2024 for company. Under its employer’s bad package, it account for the time (dates), place, and team purpose of per excursion. Their employer pays her or him a mileage allowance of 40 dollars ($0.40) a mile.

The newest Company away from Shelter establishes per diem cost to have Alaska, The state, Puerto Rico, American Samoa, Guam, Halfway, the newest Northern Mariana Isles, the fresh You.S. Virgin Isles, Wake Area, or any other low-foreign parts away from continental All of us. The fresh Service out of Condition sets for every diem costs for all almost every other international portion. A genuine organization goal can be found if you possibly could show an excellent actual team mission for the personal’s visibility. Incidental functions, such as typing cards or helping within the funny users, aren’t adequate to result in the expenditures allowable. For example, you ought to spend some the costs in the event the a resort boasts you to definitely or much more meals within its area charges.

Although not, efforts produced due to a flexible using or equivalent arrangement supplied by your employer have to be used in your income. It matter will be claimed as the earnings fit W-dos, container step 1. To figure your display of your own income tax to the combined go back, basic contour the fresh taxation both you and your mate will have paid back got you recorded independent efficiency to possess 2024 using the same submitting status in terms of 2025. Then, proliferate the newest taxation to the joint return from the after the fraction.